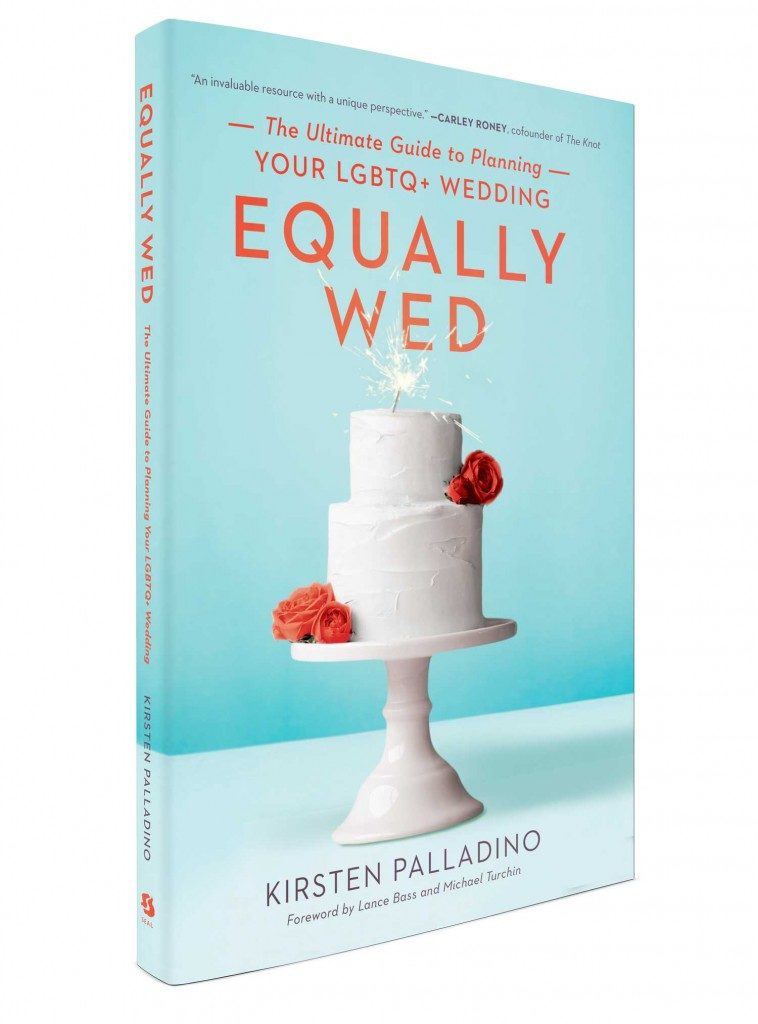

Tax refunds for same-sex couples? Yes, please.

United States Senator Elizabeth Warren and Representative Richard Neal introduced a proposed act on July 13 for tax refunds for same-sex couples. The act would allow same-sex couples the ability to amend their tax returns for the years they were required to file separately instead of filing as a joint couple. Titled “The Refund Equality Act,” the legislation would bring the opportunity for up to $67 million in refunds dating back to the date of a couple’s marriage.

Thirty-nine members of the House of Representatives and 30 senators are cosponsoring “The Refund Equality Act,” almost all of which are Democrats. The act would not apply to all same-sex couples. Couples with similar incomes most likely would not see much of a greater joint refund as opposed to those with vary incomes.

“After DOMA’s section 3, barring the federal government from recognizing same-sex marriages, was invalidated by the U.S. Supreme Court in 2013, same-sex couples could file joint federal tax returns for the first time,” writes The Advocate. “President Obama directed his administration to let married same-sex couples file amended returns for previous years to the extent allowed by law, which meant those who believe they would have received a refund if filing jointly in 2010, 2011, or 2012 could submit an amended one.”