Attending a wedding for a friend or family member is exciting! Receiving an invitation can feel like being invited to the party of the year. You’ll get to see your friends get married, catch-up with the couple’s family and see mutual friends all while enjoying a party. If you’re someone’s plus one, you might feel like the luckiest person on earth to be able to eat and drink on someone else’s dime, especially if it’s someone you’ve never met!

Getting invited to a wedding is great, but when reality of that’s involved with being a guest sets in, the costs associated with attending start to creep up. At first, it can seem like no big deal. You might find yourself thinking, what’s $100 for an appliance on their registry, they’ll only get married once! But once you begin planning for the big day, the price tags start rolling in and creating a budget is a must.

Will you be travelling to the wedding? You’ll need to budget for gas mileage, airfare, airport shuttle, rental car, ride share costs, overnight accommodations, meals while travelling and any other costs associated with how you will be travelling.

What is the dress code? Is a new outfit in order or can you wear something you already own to save money? Will you be renting?

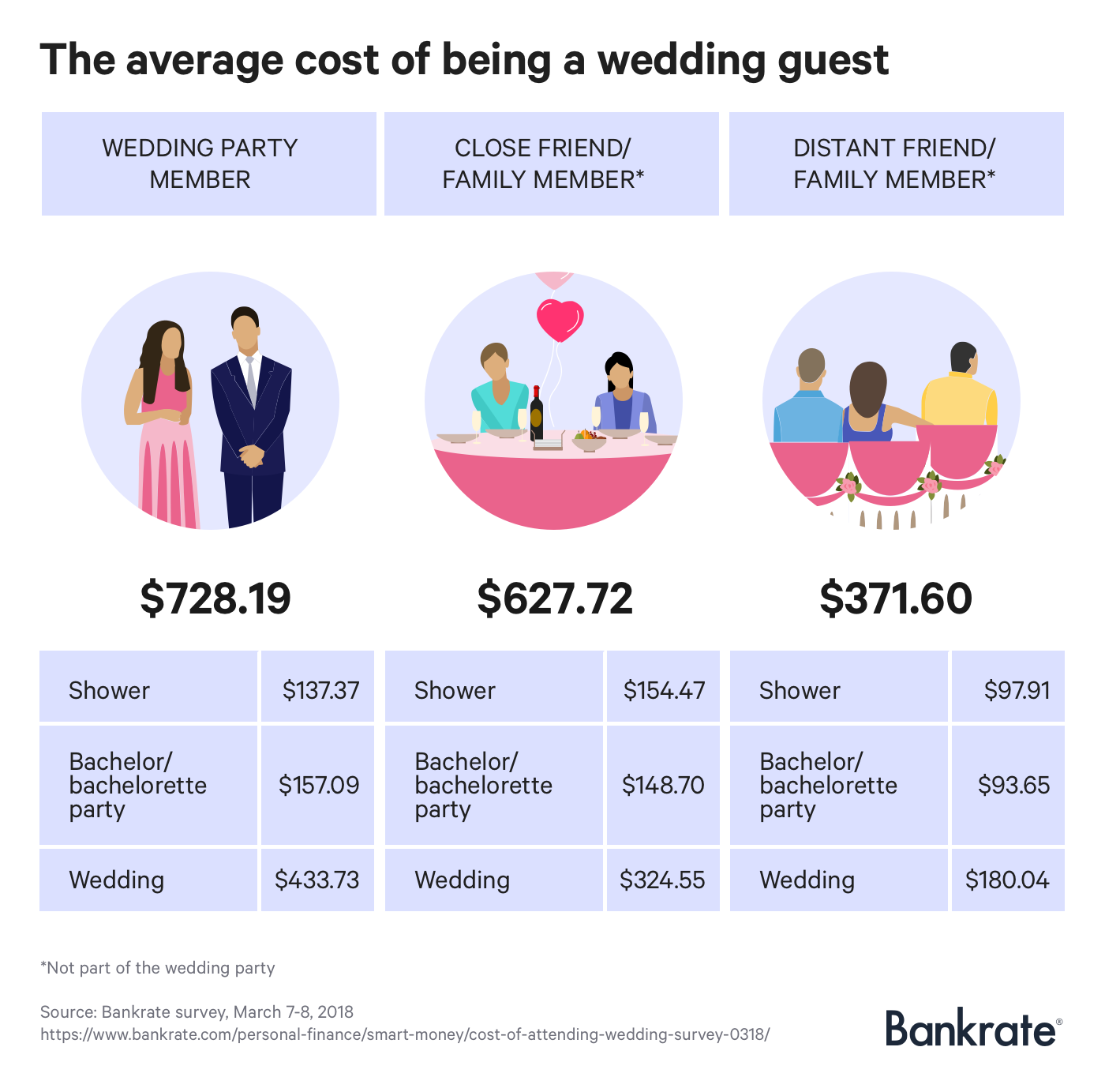

The closer you are to the couple, the more costs there will be associated with the big day. Soon you’ll be getting invited to the shower, bach party, or even an engagement party and if you’re asked to be part of the wedding party, that honor comes with even more costs.

Personal finance website Bankrate.com commissioned company YouGov Plc to conduct a survey on the actual cost of being a wedding guest. Sampling over 2,200 adults, Bankrate summarized the findings in an article on their website titled “Here’s how much you should expect to pay this wedding season.”

If the numbers above give your bank account a shock, consider Bankrate’s budgeting recommendation – start saving when the ring hits Facebook.

“Couples tend to send out save the date cards to guests between six to eight months before the event, but is that the right time to start saving?” asks the financial planning website.

“If you can afford to set aside $100 a month for the wedding after you’ve paid your bills and set aside money for your savings goals, that might be plenty of time to prepare. But if you can’t afford to set aside that much each month or if you’re saving for multiple weddings, you really ought to start planning early.

“According to wedding planning website The Knot, the average engagement lasts 15 months. If you start planning from the time the first ring selfie hits social media, you could be in a good position to survive wedding season debt-free.

“Is it presumptuous to start saving before you’ve been invited or asked to be in the wedding? Maybe, but there is no real downside — should you get overlooked, you’ll now have some extra dough to spend on yourself.”

Featured image via “New Jersey summer garden wedding“